COVID-19 UPDATE: Resources, information, and helpful tips to protect you and your family!

Senator Boscola Holds a Telephone Town Hall to discuss the Coronavirus (COVID-19).

LIVE daily briefings from the PA Department of Health:

pacast.com/live/doh or www.governor.pa.gov/live/ or watch on Facebook

Latest News

Department Of Health: Over 9.3 Million Vaccinations To Date, 52.7% Of Entire Population Received First Dose, 45.6% Of Pennsylvanians Age 18 And Older Fully Vaccinated, PA Ranks 10th Among 50 States For First Dose Vaccinations

Harrisburg, PA - The Pennsylvania Department of Health today confirmed as of 12:00 a.m., May 11, there were 2,385 additional positive cases of COVID-19, bringing the statewide total to 1,177,072. There are 1,798 individuals hospitalized with COVID-19. Of that...

Wolf Administration to Increase Indoor and Outdoor Events and Gatherings Maximum Capacity on May 17

The Wolf Administration today announced that event and gathering maximum occupancy limits will be increased to 50 percent for indoor events and gatherings and 75 percent for outdoor events and gatherings effective Monday, May 17 at 12:01 AM. “As more Pennsylvania...

Department Of Health Notes One More Step Required Before Pfizer-BioNTech Vaccine Approved For Use In 12-15 Year Olds

Harrisburg, PA - The Department of Health today applauded the U.S. Food and Drug Administration (FDA) for taking the next step to make Pfizer’s COVID-19 vaccine available to 12- to 15-year-olds, but noted one more important step is needed before vaccinations can...

Department Of Health: Over 9.2 Million Vaccinations To Date, 52.6% Of Entire Population Received First Dose, 45.3% Of Pennsylvanians Age 18 And Older Fully Vaccinated, PA Ranks 10th Among 50 States For First Dose Vaccinations

Harrisburg, PA - The Pennsylvania Department of Health today confirmed as of 12:00 a.m., May 10, there were 1,023 additional positive cases of COVID-19, in addition to 1,376 new cases reported Sunday, May 9, for a two-day total of 2,399 additional positive cases...

Department Of Health: Over 9.1 Million Vaccinations To Date, 51.9% Of Entire Population Received First Dose, 44.1% Of Pennsylvanians Age 18 And Older Fully Vaccinated, PA Ranks 10th Among 50 States For First Dose Vaccinations

Harrisburg, PA - The Pennsylvania Department of Health today confirmed as of 12:00 a.m., May 8, there were 2,610 additional positive cases of COVID-19, bringing the statewide total to 1,172,288. There are 2,012 individuals hospitalized with COVID-19. Of that...

Department Of Health Announces Free COVID-19 Testing Site In Pike County

Harrisburg, PA - The Department of Health today announced that a long-term outdoor drive-thru COVID-19 testing site will open to the public in Pike County at the Pike County Pennsylvania Welcome Center. The site is available through a partnership with AMI...

Department Of Health: Over 8.9 Million Vaccinations To Date, 51.6% Of Entire Population Received First Dose, 43.4% Of Pennsylvanians Age 18 And Older Fully Vaccinated, PA Ranks 10th Among 50 States For First Dose Vaccinations

Harrisburg, PA - The Pennsylvania Department of Health today confirmed as of 12:00 a.m., May 7, there were 2,986 additional positive cases of COVID-19, bringing the statewide total to 1,169,678. Please note, one lab is still getting caught up with backlogged data...

Department Of Health: Over 8.9 Million Vaccinations To Date, 51.2% Of Entire Population Received First Dose, 42.7% Of Pennsylvanians Age 18 And Older Fully Vaccinated, PA Ranks 10th Among 50 States For First Dose Vaccinations

Harrisburg, PA - The Pennsylvania Department of Health today confirmed as of 12:00 a.m., May 6, there were 2,476 additional positive cases of COVID-19, bringing the statewide total to 1,166,692. Please note, one lab is still getting caught up with backlogged data...

Department Of Health: Over 8.8 Million Vaccinations To Date, 50.9% Of Entire Population Received First Dose, 42.2% Of Pennsylvanians Age 18 And Older Fully Vaccinated, PA Ranks 10th Among 50 States For First Dose Vaccinations

Harrisburg, PA - The Pennsylvania Department of Health today confirmed as of 12:00 a.m., May 5, there were 2,597 additional positive cases of COVID-19, bringing the statewide total to 1,164,216 There are 2,172 individuals hospitalized with COVID-19. Of that...

Wolf Administration and Rite Aid Partner to Ease COVID-19 Vaccine Scheduling for People with Intellectual Disabilities and Autism

Governor Tom Wolf today announced a partnership with Pennsylvania-based Rite Aid Pharmacy to ease access to COVID-19 vaccinations for people with intellectual and developmental disabilities. “All Pennsylvanians are now eligible to receive COVID-19 vaccines, but we...

Wolf Administration to Lift Mitigation Orders On Memorial Day, Masking Order Once 70% Of Pennsylvania Adults Fully Vaccinated

Harrisburg, PA - The Wolf administration, in coordination with the COVID-19 Vaccine Joint Task Force, announced today that mitigation orders except masking will be lifted on Memorial Day, Monday, May 31 at 12:01 AM. The current order requiring...

Department Of Health: Over 8.7 Million Vaccinations To Date, First Doses Of Vaccine To 50.6% Of Population, PA Ranks 10th Among 50 States For First Dose Vaccinations

Harrisburg, PA - The Pennsylvania Department of Health today confirmed as of 12:00 a.m., May 3, there were 3,133 additional positive cases of COVID-19, bringing the statewide total to 1,161,619. There are 2,151 individuals hospitalized with COVID-19. Of that...

What You Need to Know About COVID-19

The Coronavirus was first discovered during an outbreak in Wuhan, China. The 2019 novel coronavirus (COVID-19) is a new virus that causes respiratory illness in people and can spread from person-to-person. Symptoms of COVID-19 can include: fever, cough, and shortness of breath. Symptoms often do not appear in a person until 2 to 14 days after exposure.

Prepare Yourself and Your Family

The best way to avoid contracting COVID-19 is by practicing vital social distancing procedures. It is recommended to work remotely and severely limit contact with others.

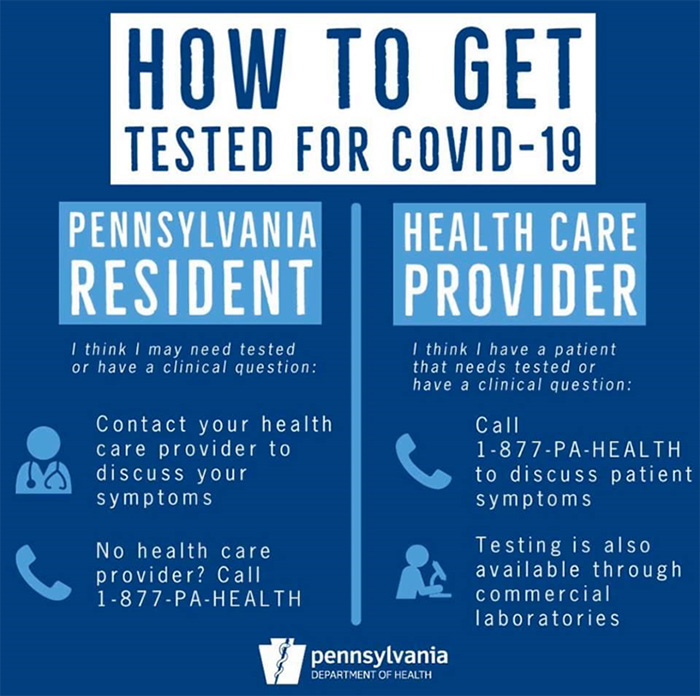

If you think you have come into contact with someone exhibiting COVID-19 symptoms or are exhibiting them yourself, please follow the instructions on the graphic below:

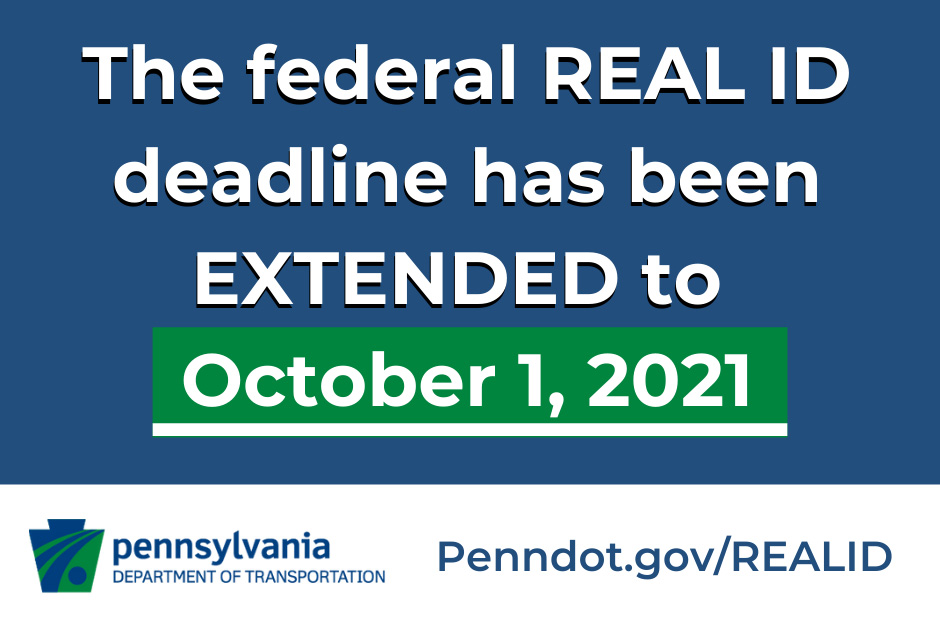

PennDOT/Real ID Updtes

Federal REAL ID Enforcement Deadline Postponed to October 2021

The Department of Homeland Security has postponed the enforcement date for REAL ID from October 1, 2020, to October 1, 2021, in response to COVID-19 and the national emergency declaration.

PennDOT closed all driver and photo license centers on March 16 and paused REAL ID issuance in the state out of an abundance of caution and in the interest of public health. Centers will reopen no sooner than April 3. PennDOT also sent a letter to the U.S. Department of Homeland Security, requesting that the agency consider extending the October 1, 2020 REAL ID enforcement deadline.

REAL ID is a federal law that affects how states issue driver’s licenses and ID cards if they are going to be acceptable for federal purposes. A federally-acceptable form of identification (whether it’s a Pennsylvania REAL ID driver’s license or ID card, a valid U.S. Passport/Passport Card, a military ID, etc.) must now be used on and after October 1, 2021, as identification to board a commercial flight or visit a secure federal building that requires a federally acceptable form of identification ID for access.

REAL ID is optional in Pennsylvania. There is no requirement that any resident obtain a REAL ID; PennDOT will continue to offer standard-issue driver’s licenses and photo IDs once issuance has resumed.

More information about document requirements, including a printable document checklist, can be found on the Document Check page of the PennDOT Driver and Vehicle Services website.

Small Business Assistance

Small businesses are the backbone of our Commonwealth and this nation!

Do you have a business in the Lehigh Valley? The Lehigh Valley Economic Development Corporation(LVEDC) wants to hear from YOU! LVEDC is conducting a survey to assess the impacts of Coronavirus (COVID-19) on local business to determine how they can best assist – to participate, CLICK HERE. Furthermore, if you have any questions and do not know who to reach out to regarding your business send an email to: sierra.serfass@pasenate.com

Small Business Loan: The Federal Small Business Administration (SBA) and the Pennsylvania Department of Community and Economic Development (DCED) are working to provide Disaster Assistance Loans for Small Businesses Impacted by Coronavirus (COVID-19).

Small Business Disaster Loan Assistance (SBA)

The U.S. Small Business Administration, in addition to local funding partners, may also be a source of assistance for affected businesses with funding opportunities up to $2 million. Learn more on how to apply here.

The Small Business Administration has just opened their applications for Disaster Loan Assistance. Small businesses can apply at https://disasterloan.sba.gov/ela/.

SBA disaster loans offer an affordable way for individuals and businesses to recover from declared disasters. The interest rate is 3.75% for small businesses without credit available elsewhere; businesses with credit available elsewhere are not eligible. The interest rate for non-profits is 2.75%. As a small business, small agricultural cooperative, small business engaged in aquaculture, or private non-profit organization you may borrow up to $2 million for Economic Injury. Applicants may also call SBA’s Customer Service Center at (800) 659-2955 or email disastercustomerservice@sba.gov for more information on SBA disaster assistance.

For questions, please call SBA Call 1-800-659-2955 (TTY: 1-800-877-8339) or e-mail disastercustomerservice@sba.gov (link sends e-mail).

PAYCHECK PROTECTION PACKAGE

As a small business, are you eligible for the COVID-19 loan under the “Paycheck Protection Package”?

The “Paycheck Protection Program” was created to help small businesses weather the economic uncertainty resulting from the pandemic. This $349 billion lending program provides loans that are 100 percent guaranteed by the U.S. government for small businesses. The loans must be used to retain workers, maintain payroll, make mortgage or lease payments or pay utilities.

The borrower will have a portion of their loan forgiven in the amount equal to payroll costs (not including costs for compensation above $100,000 annually), interest payments on mortgages, rent payments and utility payments between Feb. 15 and June 30, 2020.

The U.S. Senate Committee on Small Business & Entrepreneurship has developed a FAQ document to help small businesses learn more about the program. That document can be found here.

To apply for a loan: Paycheck Protection Package

VOLUNTEER FIRE DEPARTMENT FUNDING

A new federal stimulus program passed in response to the COVID-19 pandemic allowing volunteer fire companies to apply for the Small Business Administration’s Economic Injury Disaster Loans (EIDL) and Paycheck Protection Loans (PPP). At this time, I am strongly urging all volunteer fire departments to check out these programs and seek federal help during this very difficult time, if need be.

VFD assistance from the federal stimulus will allow qualifying volunteer fire companies to apply for EIDL and PPP loans with funds that will be made available very quickly. Qualifying volunteer organizations that pay firefighters can also access federal funds through the PPP. Under this program, loans will be forgiven if employees are kept on the payroll for eight weeks and the funds are used for payroll, rent, mortgage interest or utilities.

EIDL loans can provide up to $2 million in working capital with emergency grants immediately available. An advance of $10,000 for volunteer fire companies organized as IRC 501 (c) (3) of IRC 501 (c) 4 can be accessed within three days of application. Organizations applying for funding will not be required to repay the funds, even if a loan application is ultimately rejected.

Additional information can be found at https://www.iafc.org/blogs/blog/iafc/2020/04/02/volunteer-departments-eligible-for-cares-act-loan-programs

Protect Yourself

Medical Costs

As of March 9, the Governor announced that all major health insurers in Pennsylvania have agreed to cover “medically appropriate” COVID-19 testing and treatment.

The 10 major insurers are:

- Aetna

- Capital Blue Cross

- Cigna

- Geisinger

- Highmark

- Independence BlueCross

- Oscar

- Pennsylvania Health & Wellness

- UnitedHealthcare

- UPMC Health Plan

For anyone with questions about their insurance policy, please contact your insurer or the Pennsylvania State Insurance Department with questions. They can also be reached at (877) 881-6388.

Remote Medical Attention and Care

Health officials are urging people who have symptoms to stay home and contact their doctor remotely rather than opting for an in-person visit. Nearly all major health systems offer some form of virtual visits and assistance. Some insurers do, too. People interested in a specific virtual visit should check to see what illnesses it can be used for. Be sure to reach out to your insurance provider to verify this service is covered with your plan.

Here’s an brief overview of virtual visit services offered to local residents:

Capital BlueCross – is offering free medical Virtual Care visits for members who currently have the Virtual Care benefit. The waiving of fees will be effective March 13 through April 15, 2020.

Highmark – is providing many of their members with a virtual clinic visit service. Any fees related to COVID-19 will be waived.

UPMC Pinnacle – is welcoming Online Video Visits for those experience flu like symptoms or just in need of a follow-up appointment. Video visits are available through the MyPinnacleHealth portal for $49.

WellSpan Health – WellSpan Online Urgent Care offers a video visits with Teladoc physicians for patients 3 months and older for their standard fee of $49.

CALLING ALL PSYCHOLOGIST! Things may be picking up for you at this time, so we want to make sure you are covered too. Here are some COVID-19 resources on how to best protect yourself and serve your patients from the Pennsylvania Psychologist Association.

Feeding Kids During COVID-19: Emergency Grants and Updated Resources

No Kid Hungry is offering real-time emergency grant funding to schools and community organizations that are making sure kids have access to the meals they need as schools close due to coronavirus. The need is devastating; we received thousands of requests for grants in the first few days, and heard heart-breaking stories. To date, they have awarded more than $3.9 million in grants to 147 organizations across 40 states and DC.

No Kid Hungry is providing millions of dollars in additional grants in the coming weeks for schools and local non-profits in our communities that could benefit from this program to continue providing critical nutrition assistance. For additional information on the program and application process, please CLICK HERE.

How to Stay Informed

Below is an extensive list of information, statistics, and resources to ensure you stay up-to-date with any changes happening due to COVID-19.

Boscola Bulletins

- Make sure you are signed up to receive the Boscola Bulletin (you can sign up HERE)

- To view all past issues of the Boscola Bulletin eNews, CLICK HERE

Pennsylvania Department of Health

- The PA DoH Daily COVID-19 report. Updated regularly throughout the day.

- Follow the PA Health Department on Twitter.

- Follow them on Facebook.

A complete list of information and resources available to you by county:

U.S. Centers for Disease Control and Prevention

- Track confirmed cases in the US. (This site is updated weekdays at noon and shows numbers that were current as of 4 p.m. the previous day.)

- CDC provided information regarding “What you should know about COVID-19”

- Follow the CDC on Twitter.

- Follow the CDC on Facebook.

- Learn how best to prevent “community transition” with specific details on what to do before, during, and after outbreaks.

World Health Organization

- Learn what’s happening Worldwide with the WHO’s Daily report. The most recent report is located at the top of the page. It includes confirmed case and death tallies.

- Additional COVID-19 information is provided on their website.

- Stay informed on Twitter.

- Follow their Facebook page.